Loan originators and borrowers automate operations, streamline reporting, and optimize capital use on Setpoint.

Spend less time managing lender & investor requirements.

Setpoint is the single thread for warehouse and securitization management.

Save time & money

Streamline funding operations with automated data ingestion, calculations and reporting workflows.

Drive growth

Run any number of scenarios or leverage our AI-driven engine to determine optimal asset allocation.

Increase liquidity

Access real-time Third-Party Reviews and certifications, improving capital access while ensuring compliance.

Here’s how it works.

Start optimizing your capital, with zero lift needed from your engineering teams.

Manage all financing sources in one place.

Debt Capital

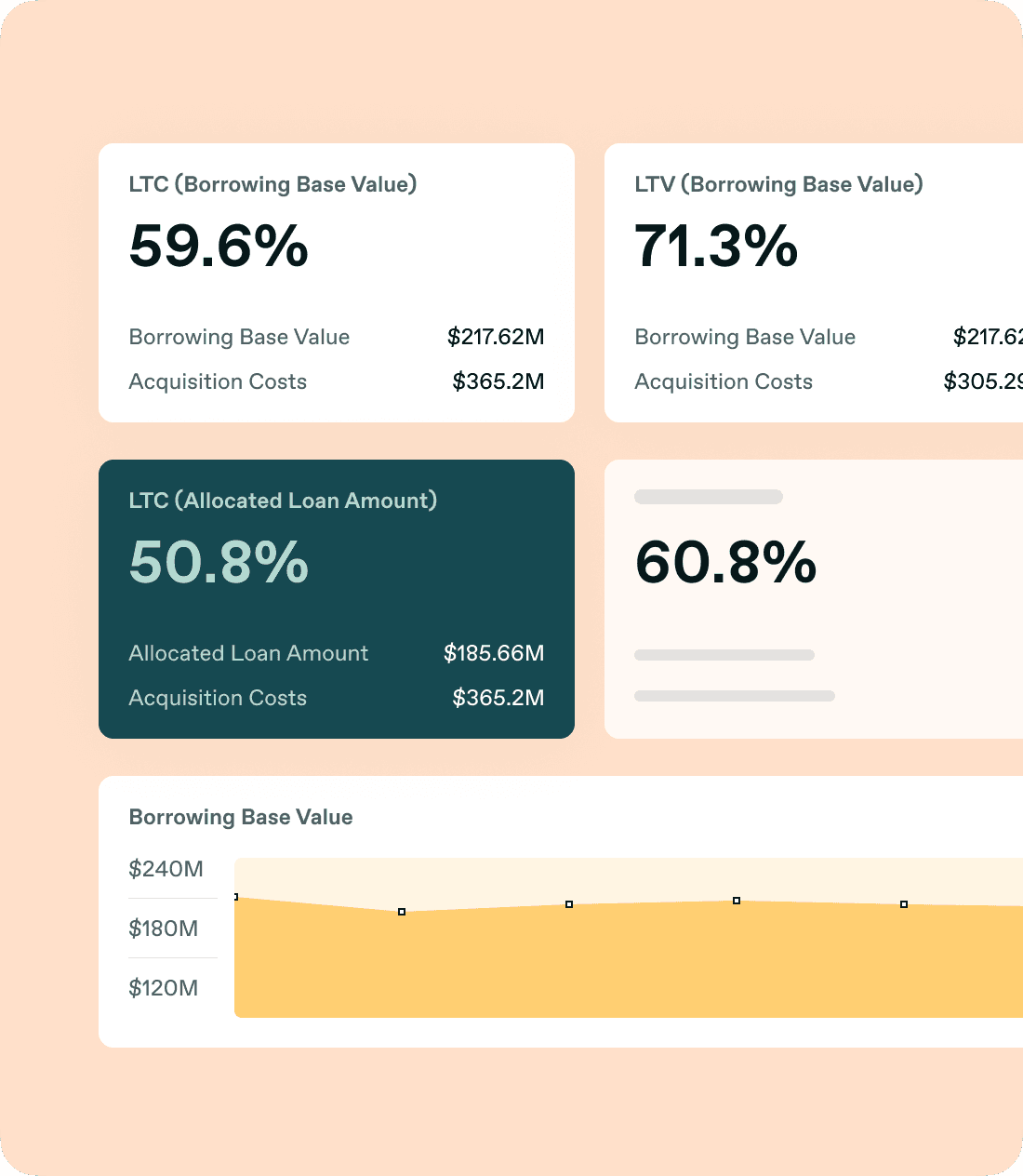

Fund intraday, automate borrowing requests & reporting, optimize pledging, and forecast lender compliance.

Securitized Products

Automate investor reporting, asset & collateral management workflows, and select optimal static pools to securitize.

Equity Capital

Allocate efficiently based on acquisition partner requirements, originate based on funding capacity, and forecast portfolio performance.

Resources from Setpoint.

Speak to our experts, today.

Get simple software and tech-enabled Third Party Services, faster than ever before.