The Problem

Inefficient email workflows delayed funding and complicated lender communications

Pathway Homes, a single-family residential leasing platform, provides aspiring homeowners with rent-to-own solutions that help them transition into ownership. Their business model relies on efficient warehouse draw funding to acquire properties in bulk at different times. Any delays in funding could slow acquisitions and impact lender relationships.

“When I first took over the management of our debt facility at Pathway, the first thing I saw was the chaos in the email workflow,” says Corey Kirk, Head of Finance and Accounting at Pathway Homes. “I remember thinking—2005 called and wants its email workflow back.”

Without software to automate warehouse activities, Pathway’s team spent a significant amount of time and resources managing their facility. Their previous calculation agent—a third-party provider responsible for verifying loan tape accuracy and ensuring compliance before funds were disbursed—only saw the data for the first time when Excel tapes were submitted via email to every lender contact. The process was inefficient—with thousands of data points to review, even minor discrepancies triggered extensive email exchanges that frequently involved 50+ participants, delaying funding operations.

“The impact of our previous calculation agent relationship and the manual inefficient process involved with all warehouse activities was causing us to spend extra time,” Kirk recalls. “There are thousands of data points in our tapes, and identifying errors only after submission caused unnecessary stress and back-and-forth with lenders.”

These inefficiencies weren’t just operational; they also highlighted the need for a faster, more reliable funding process. “When you’re dealing with real estate sellers and needing quick funding, speed is critical—not just financially, but in maintaining strong business relationships,” Kirk adds.

Pathway needed a modern, automated solution to streamline funding requests, reduce manual errors, and strengthen their lender relationships.

The Problem

Inefficient email workflows delayed funding and complicated lender communications

Pathway Homes, a single-family residential leasing platform, provides aspiring homeowners with rent-to-own solutions that help them transition into ownership. Their business model relies on efficient warehouse draw funding to acquire properties in bulk at different times. Any delays in funding could slow acquisitions and impact lender relationships.

“When I first took over the management of our debt facility at Pathway, the first thing I saw was the chaos in the email workflow,” says Corey Kirk, Head of Finance and Accounting at Pathway Homes. “I remember thinking—2005 called and wants its email workflow back.”

Without software to automate warehouse activities, Pathway’s team spent a significant amount of time and resources managing their facility. Their previous calculation agent—a third-party provider responsible for verifying loan tape accuracy and ensuring compliance before funds were disbursed—only saw the data for the first time when Excel tapes were submitted via email to every lender contact. The process was inefficient—with thousands of data points to review, even minor discrepancies triggered extensive email exchanges that frequently involved 50+ participants, delaying funding operations.

“The impact of our previous calculation agent relationship and the manual inefficient process involved with all warehouse activities was causing us to spend extra time,” Kirk recalls. “There are thousands of data points in our tapes, and identifying errors only after submission caused unnecessary stress and back-and-forth with lenders.”

These inefficiencies weren’t just operational; they also highlighted the need for a faster, more reliable funding process. “When you’re dealing with real estate sellers and needing quick funding, speed is critical—not just financially, but in maintaining strong business relationships,” Kirk adds.

Pathway needed a modern, automated solution to streamline funding requests, reduce manual errors, and strengthen their lender relationships.

The Solution

An automated, software-driven approach to warehouse management

After learning about Setpoint, Pathway quickly saw the value of the platform. “We didn’t spend much time evaluating other options because, from the first demo, it was clear that what we had in place was extremely outdated,” says Kirk.

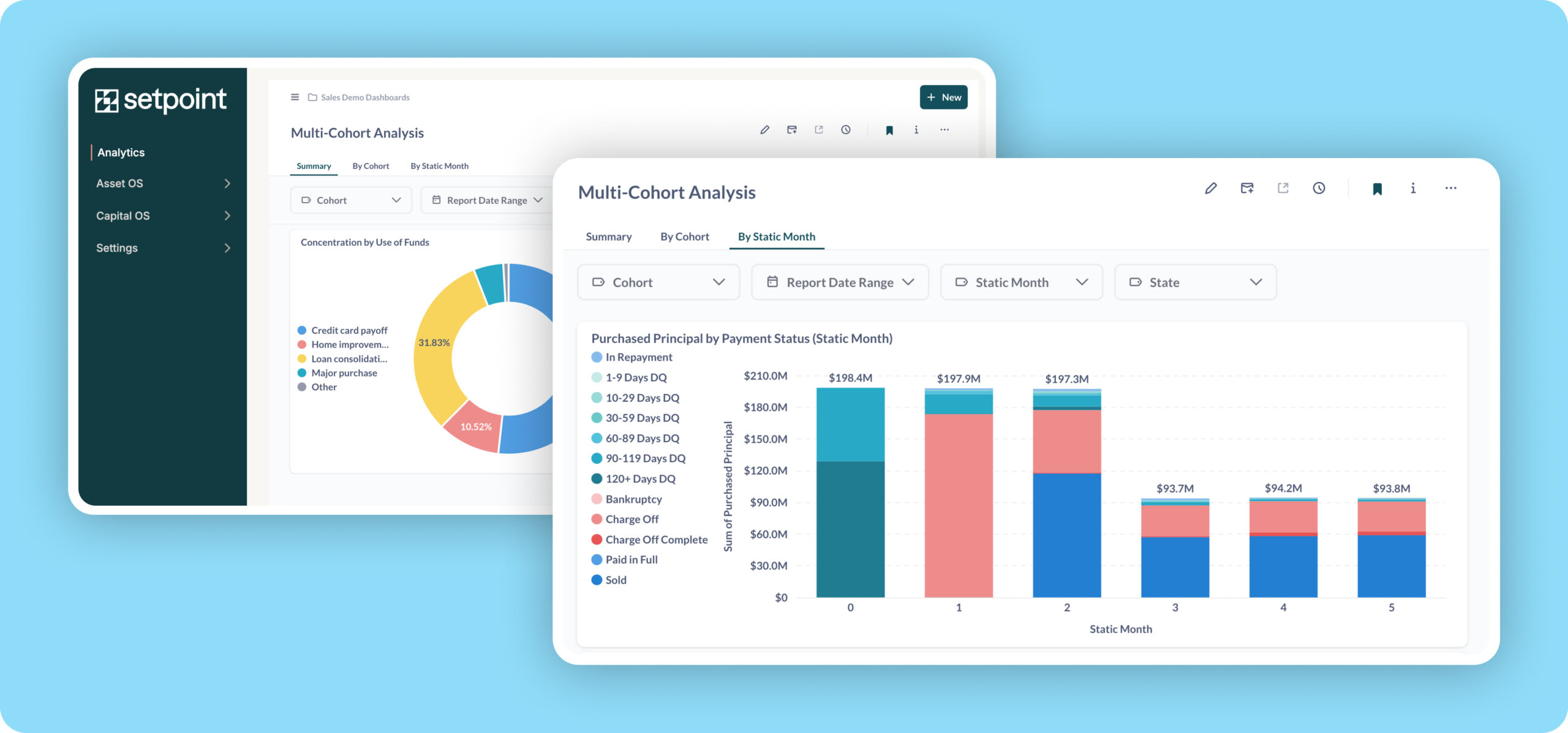

As Pathway’s new calculation agent, Setpoint’s platform introduced a fully integrated and automated system, replacing their inefficient email-based workflow. Key benefits included:

- Automated data submission: Pathway now submits their Excel tapes directly into Setpoint’s software, which checks for errors and inconsistencies before the tape is visible to lenders or outside parties, reducing confusion and massive email chains.

- Built-in loan agreement logic: The system flags errors and inconsistencies instantly, making them quick and easy to correct. This is critical given how quickly Pathway needs funding at various times.

- Seamless implementation: Setpoint’s technical team was able to quickly map Pathway’s facility agreements, adapting the platform to their specific requirements while ensuring a smooth, simplified onboarding experience.

- Healthier lender communications: Minimizing long email chains full of questions and error messages reduced friction, making the process with lenders smoother and more professional.

“The biggest thing that stood out about Setpoint was how seamlessly it integrates with our facility agreements,” says Kirk. “We can now submit our tapes, identify errors immediately, and eliminate manual back-and-forth.”

Pathway Homes now uses Setpoint for all warehouse activities, from adding and removing properties from the debt facility to monthly remittances and lender reporting.

The Result

Faster funding, streamlined operations, and stronger lender relationships

Since implementing Setpoint, Pathway Homes has achieved major operational improvements:

- A full day saved per funding request: The previous manual process took an entire day; now, with Setpoint, it takes just 30 minutes.

- More efficient operations: Reducing email-based workflows has significantly shortened time spent managing debt facilities.

- Stronger lender relationships: By removing back-and-forth error corrections, lenders now receive clean, validated data upfront.

- Enhanced visibility and reporting: Pathway now automates historical warehouse asset and debt covenant reporting, rather than building from scratch in Excel.

“The time savings alone are incredible,” says Kirk. “Before Setpoint, we spent a full day just resolving data errors through email chains. Now, that’s a 30-minute process. That’s a huge impact when you’re working with a short funding window.”

The benefits extend beyond efficiency:

“Setpoint has improved our lender relationships because they’re no longer seeing all the internal back-and-forth on data errors. So, they’re much happier because they don’t have to sift through all that information. That’s been a game-changer for us,” Kirk adds.

Beyond implementation, Setpoint continues to provide value. “We were surprised by how Setpoint’s team continued to improve our processes beyond just onboarding. They still work with us today to optimize other areas,” Kirk notes.

With Setpoint now an essential part of their operations, Pathway Homes has not only reduced inefficiencies but also positioned itself for scalable, stress-free growth.

“Pathway’s partnership with Setpoint has exceeded our expectations,” says Kirk. “The implementation was seamless, and we’ve gained a ton of efficiency across all our warehouse activities. From our experience, switching to Setpoint as a calculation agent is a no-brainer—we’d recommend them to anyone.”