Speak to our experts, today.

Get simple software and tech-enabled Third Party Services, faster than ever before.

Say goodbye to complex Excel spreadsheets and endless email chains. Setpoint’s Calculation & Paying Agent Services streamline the funding process for borrowers and lenders, offering real-time verification and transparent reporting. Our platform ensures accurate data, reduces manual errors and missed emails, and speeds up approvals, transforming how you manage funding operations.

A calculation agent verifies the accuracy of a borrower’s data and reporting before disbursing funds from an asset-backed credit facility. This role is vital for capital providers to ensure the borrower’s loan tape data and calculations are accurate, reducing the risk of over-advances.

Capital providers may require a calculation agent to review and verify reports based on a borrower’s data tape for each funding request. If inconsistencies are found, the calculation agent prompts the borrower for corrections. Once verified, the agent produces a report confirming that funds can be distributed, provided all other conditions are met.

Today’s calculation agent processes are riddled with inefficiencies. Traditional methods take days to verify data, often relying on large Excel files shared via email, leading to manual reconciliation and delays in monthly reporting. These processes are error-prone and often operate in a “black box” environment, providing limited visibility and audit capabilities for lenders and borrowers. The frequent back-and-forth for ad-hoc data requests and reliance on inconsistent templates create bottlenecks and increase workloads—issues Setpoint aims to eliminate.

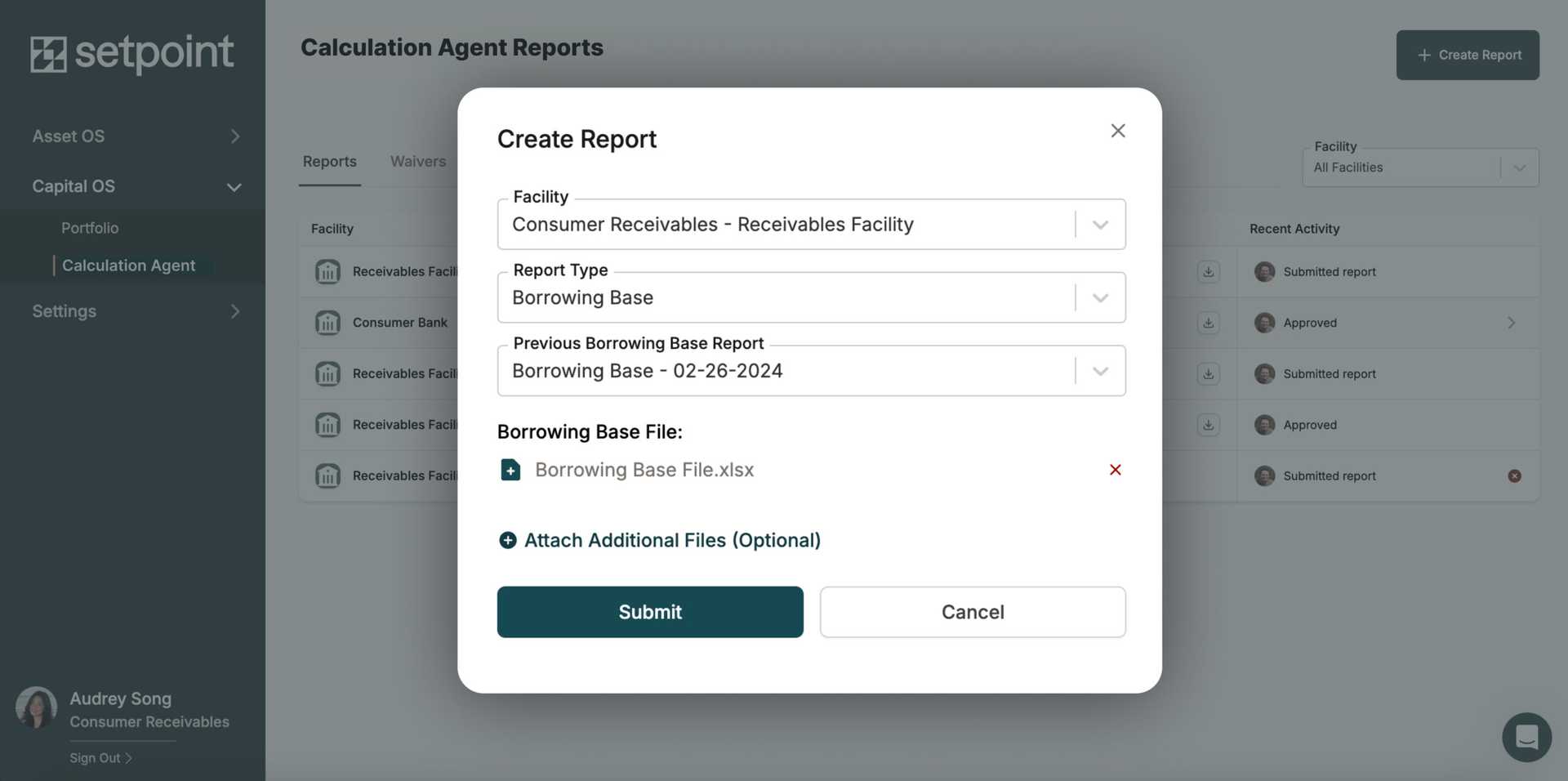

Setpoint first digitizes your loan agreements and configures borrowing base reports, funding requests, and monthly settlement statements, embedding the facility logic and tests into Setpoint’s Capital OS. Setpoint creates a reliable source of truth that seamlessly integrates into your workflow, saving you time and speeding up approvals.

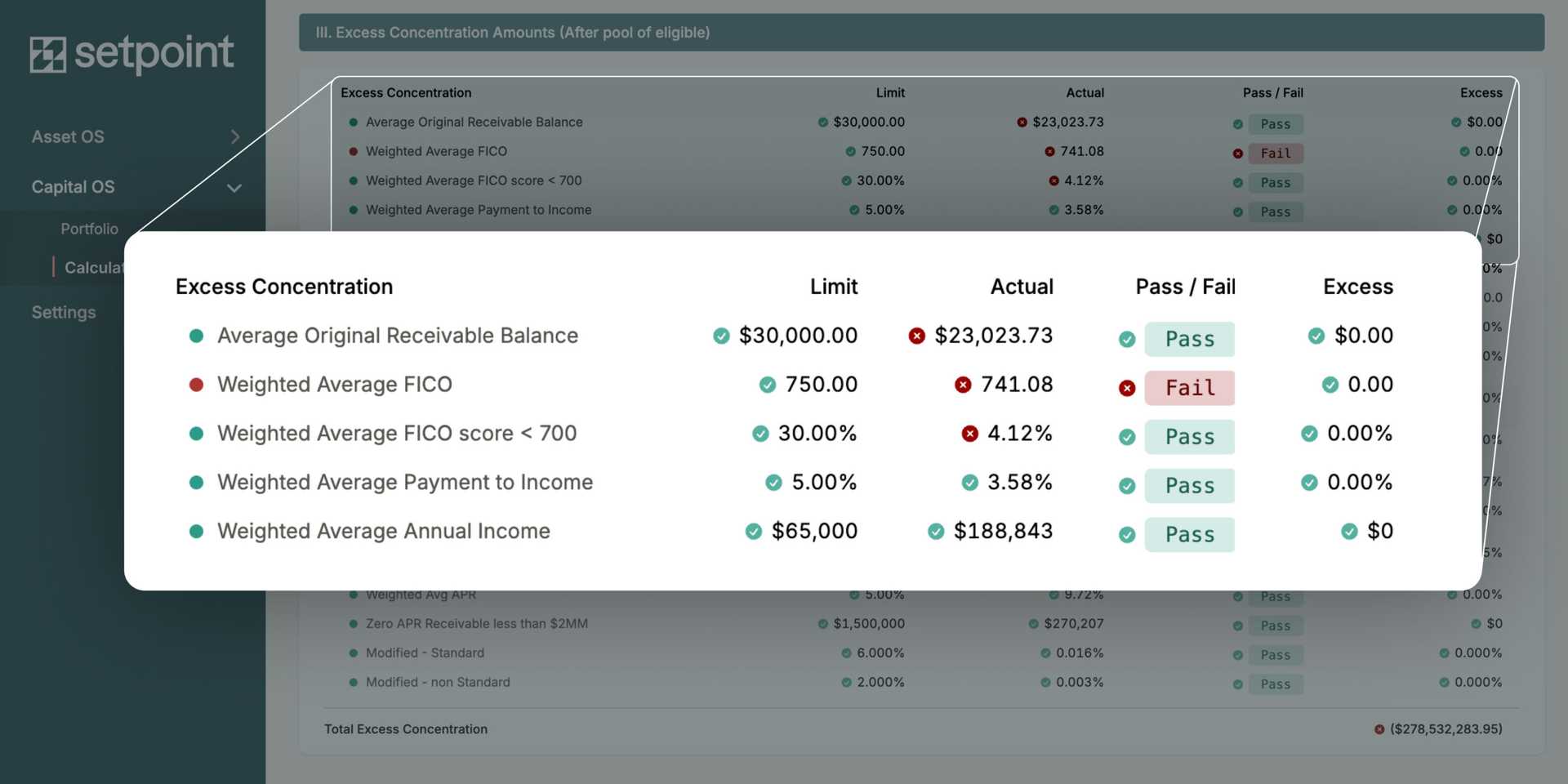

With the digitized agreements in place, Setpoint’s platform automatically performs calculations to verify borrowing bases. Our platform handles a variety of reports, including borrowing requests, monthly settlements, cash recycling reports, and collateral release calculations. This automation ensures that all financial activities are within the agreed terms, significantly reducing manual errors and accelerating the approval process.

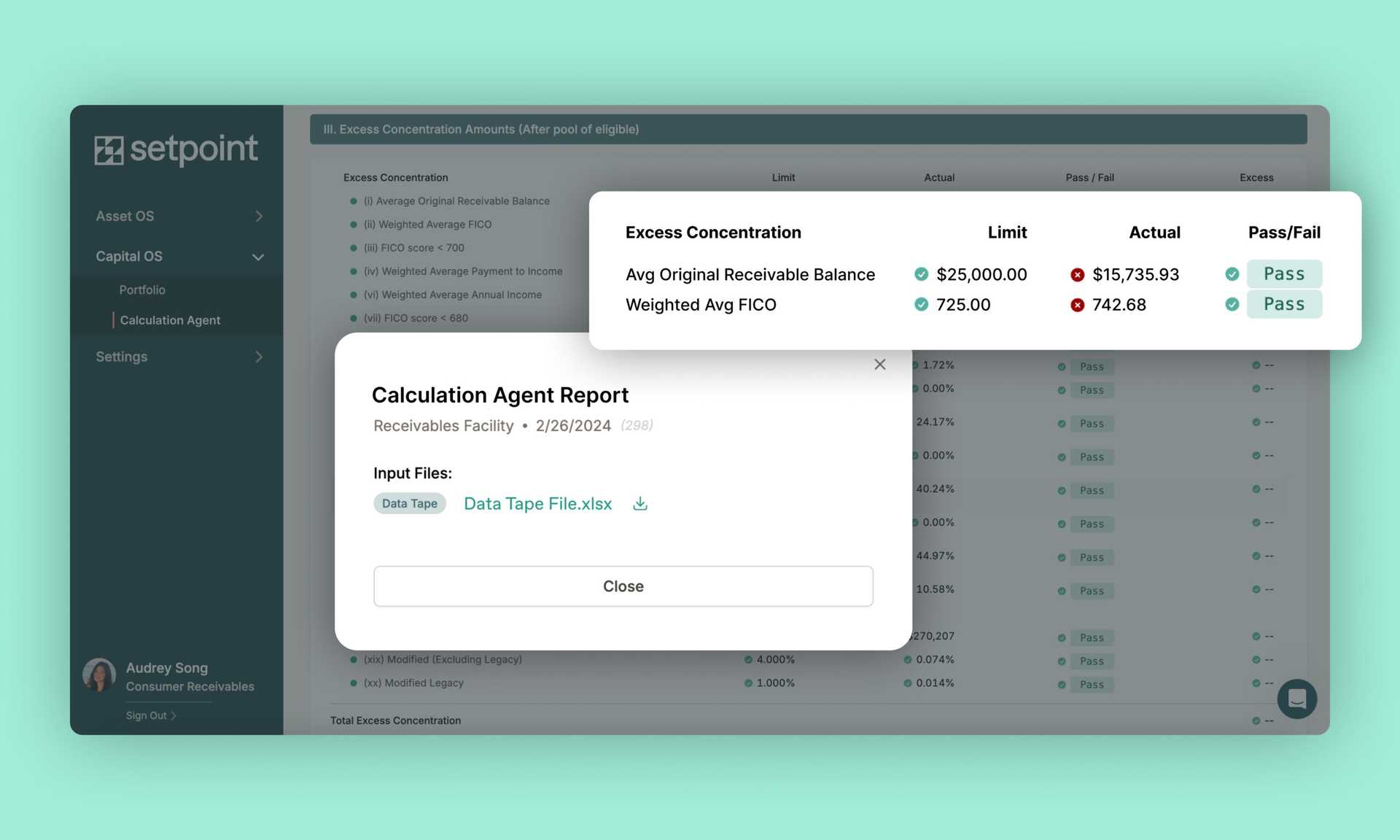

Setpoint verifies the uploaded data tape and reports within minutes, providing real-time validation. Unlike other calculation agents that take days, Setpoint operates in real-time, offering faster approvals and quicker access to funds. The generated reports show checkmarks and flags to indicate which calculations match or have discrepancies, and we expose the exact Excel formulas used, guiding borrowers or lenders on how to correct any issues.

Setpoint’s real-time validation allows borrowers to run reports before submitting the actual request, proactively addressing potential issues and ensuring a smooth, timely reporting process.

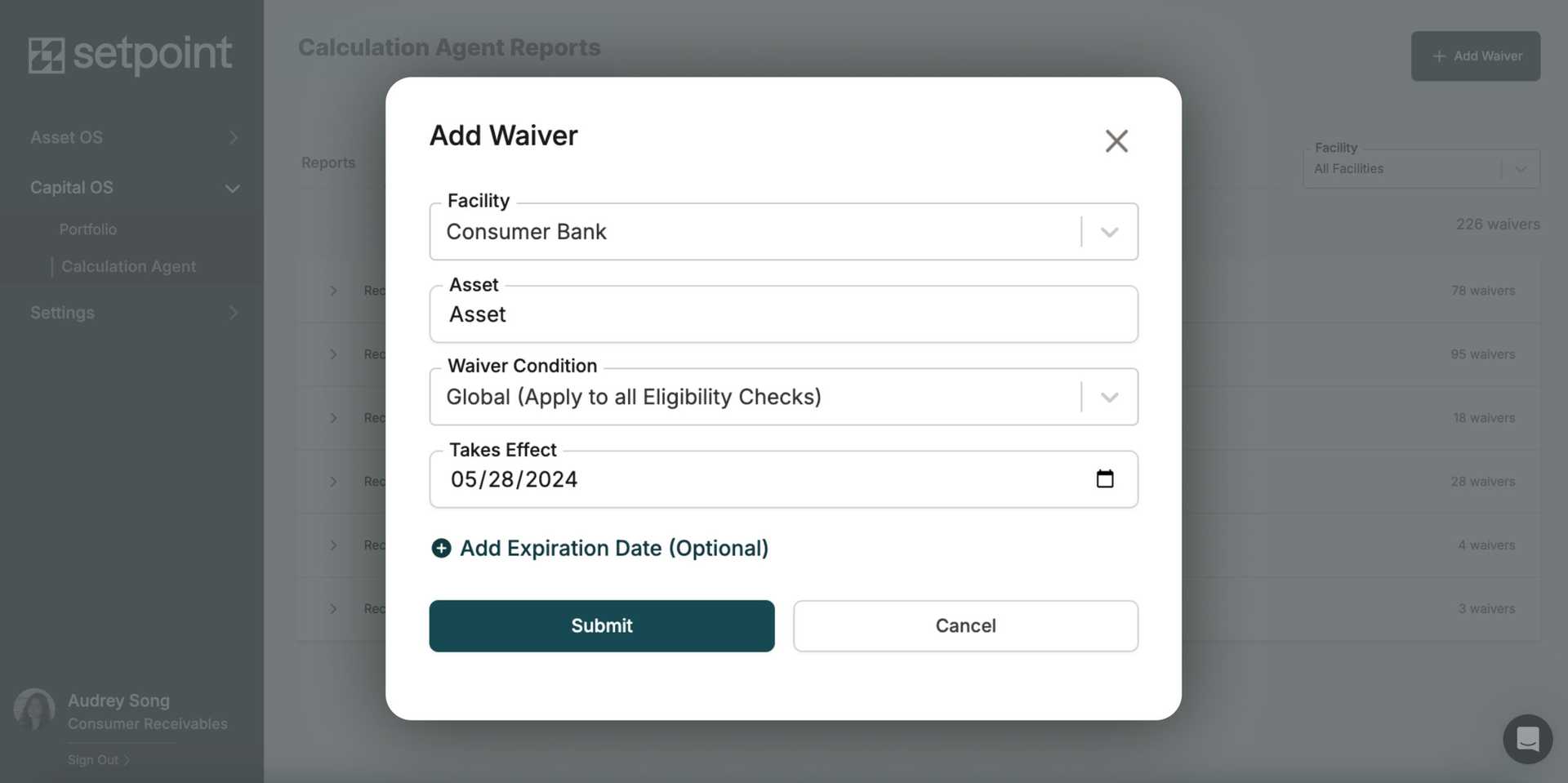

Our platform streamlines communication between lenders and borrowers with features like in-app messaging, waiver requests, and audit logs. This seamless interaction ensures no more missed emails or miscommunications, making collaboration smooth and reliable. You can easily access and download both input documents and final output reports anytime, providing complete transparency and allowing you to keep track of your funding process with ease.

Setpoint can also act as your Paying Agent, facilitating payments based on the Calculation Agent’s instructions. Whether you use our many bank partnerships or your existing bank, we minimize friction and ensure every transaction is timestamped and reconciled against our calculation reports, providing unmatched accuracy and peace of mind. From sending payment instructions to tracking Fed Ref IDs, every transaction is documented, enhancing trust and reliability.

By digitizing and automating the verification process, Setpoint’s Calculation and Paying Agent saves time, reduces costs, and ensures the accuracy of your funding process.

Get simple software and tech-enabled Third Party Services, faster than ever before.